Central Banks Urged to Factor Climate Shocks into Labour Market Policy

- bySheetal

- 31 July, 2025

A report published on July 23, 2025, by the London School of Economics’ Centre for Economic Transition Expertise (CETEx) warns that central banks must overhaul their monetary policy frameworks to account for the impact of climate-related shocks on labour markets. Under even moderate global warming scenarios (1.5–2 °C), productivity declines are expected in heat-sensitive sectors such as agriculture and construction, placing up to 1.2 billion workers across 182 countries at risk.

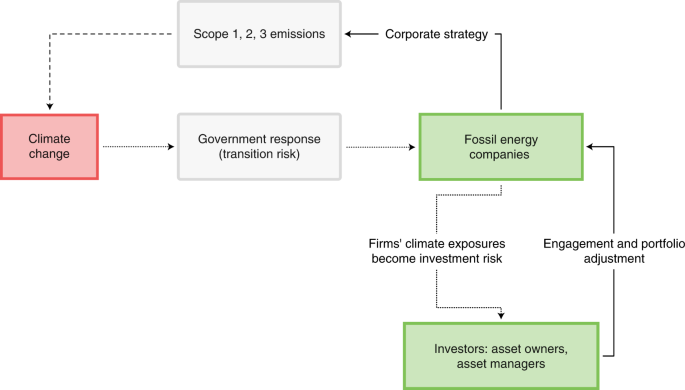

The study underscores that labour disruptions arising from physical risks (floods, droughts, heatwaves) and transition risks (industry shifts away from polluting sectors) could exacerbate inflation, inequality, and unemployment. While some central banks—like the Bank of England and ECB—have started acknowledging these risks, many others lack employment mandates that enable proactive climate response.

CETEx author Joe Feyertag emphasizes that central banks should explicitly integrate environmental employment vulnerabilities into their monetary models and explore policy tools that support demand for low-carbon jobs. Without such adaptation, central banks risk being caught off guard by climate-driven disruptions that threaten price stability and financial resilience.

Further reading on climate‑monetary risks

Note: Content and images are for informational use only. For any concerns, contact us at info@rajasthaninews.com.

"इको-फ्रेंडली इनोवेश...

Related Post

Recent News

Daily Newsletter

Get all the top stories from Blogs to keep track.

_1772816273.png)

_1772815476.png)